Planning and forecast functionality in iSupplier Portal.

Basic objective of this whitepaper is

>Identifying

a key setups to complete Demand planning to supply flow

>Identifying

the role of advanced modules like ASCP to achieve better execution of Supplier scheduling

process

>Basic

flow of ASCP

Setup

Step 1: Item creation

Note: Item should be ‘Purchased’ and ‘Purchasable’

enabled. Ensure ‘planner’ is entered under general planning tab (At organization level) Ensure it’s a

‘Buy’ item.

In the MPS/MRP Planning tab - the item should have a planning method

- MRP Planning (Or method of planning used at the Location)

- Create Supply

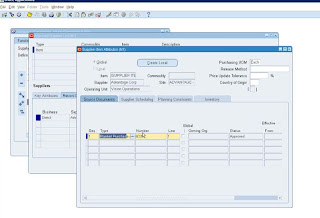

Step7: Run ASCP Data Collection (From Advanced Supply Chain Planner)

Step11: Execute Push Plan (From Advanced Supply Chain planner Responsibility)

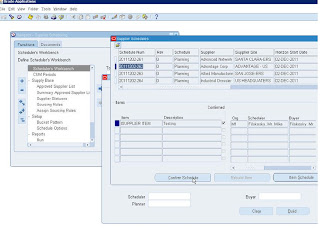

Responsibility : Supplier Scheduling

Generate Schedules and Confirm schedules.. Once schedule line is confirmed it will display in iSupplier

View Data in iSupplier Portal

Comments

Post a Comment